non filing of income tax return notice reply

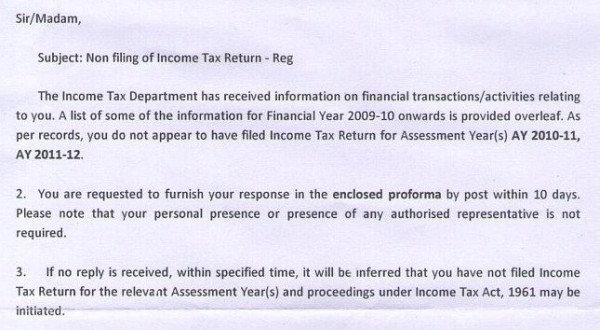

The I-T Department could send you notices either by post or email. This type of notice is generally received when a person fails to file the income tax return for a particular years when he had.

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

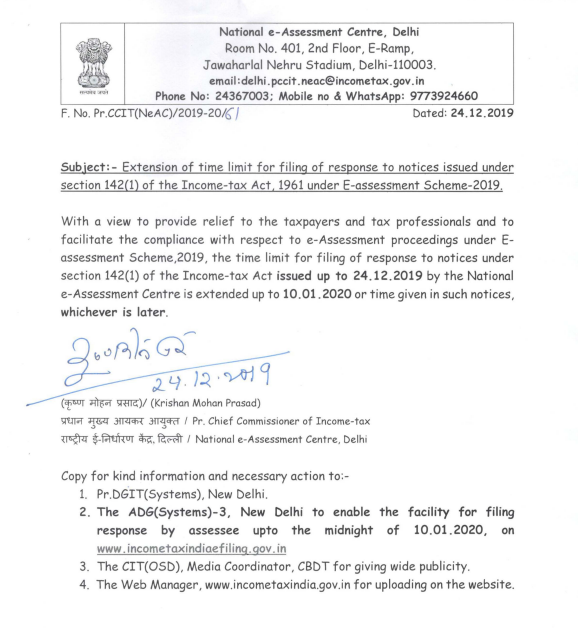

You can respond to the notice through your income tax e-Filin.

. The assessed has 15 days to reply to such notice. This notice is generally received when there is a mistake or a defect in the return filed. Notice us 139 9 for filing defective return.

Visit the income tax departments online portal by typing wwwincometaxindiaefilinggovin in. These notices could be for scrutiny non-filing delayed filing or filing of defective ITR non-disclosure of income tax credit. Kindly note that if there is no taxable income then there is no need to pay tax or file income tax return.

Response To Income Tax Notice by best Consultant in Jaipur Rajasthan India. 5000 for missing the deadline. You can respond to the notice of non-filing of returns via online channel.

Notice for Non-Filing of Income Tax Return. Click on the Compliance Tab and then click View and Submit. Call 911-911-2929 for free Income Tax Notice consultancy.

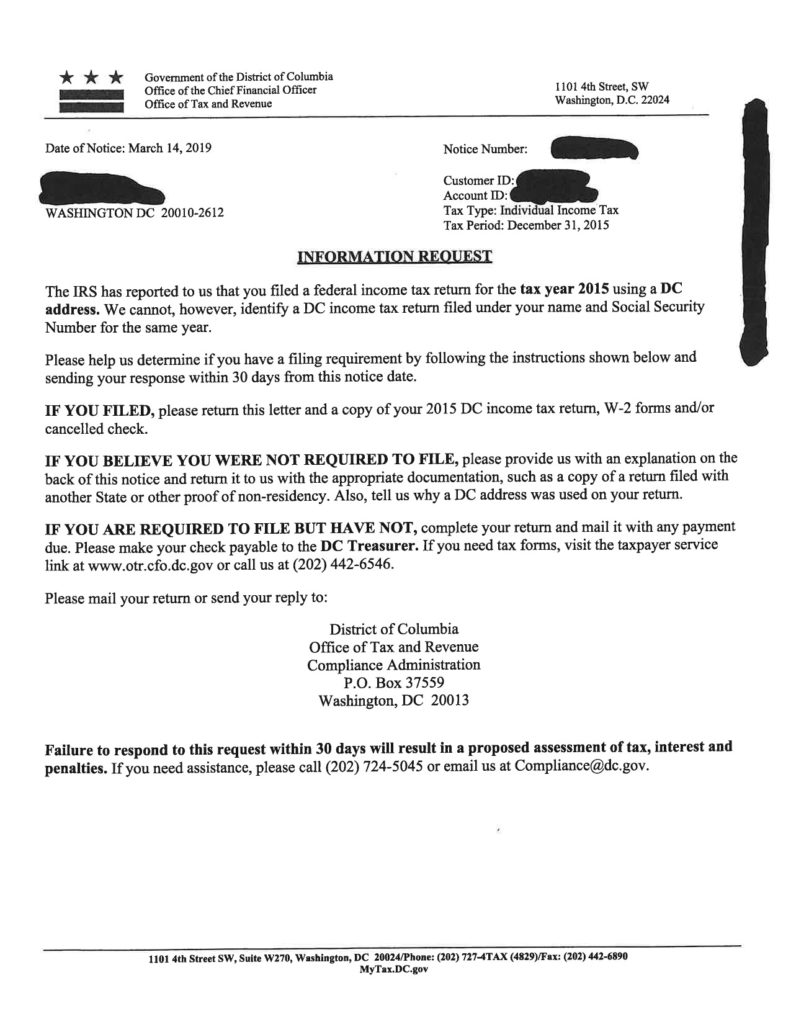

If you are new then you have. You can reply to such a notice by following these steps-. What is an IRS Verification of Nonfiling Letter.

How to to respond Non filling of return notice from income tax department In this video we have explained how you can response to Income tax e-campaign not. You reply non filing of income tax return notice is. Login to your account on the website incometaxindiaefilinggovin.

II Notice for non-filing of income tax return. You may have to pay a penalty of up to Rs. Following is a step-by-step guide on how to respond to the notice for non-filing of returns.

This is on the grounds that the Income Tax Department can. Firstly you have to Login to your e- filing account at incometaxindiaefilinggovin with your username and password. Hello frienda in this video we will see How to reply to non-filing of Income Tax Return Notice.

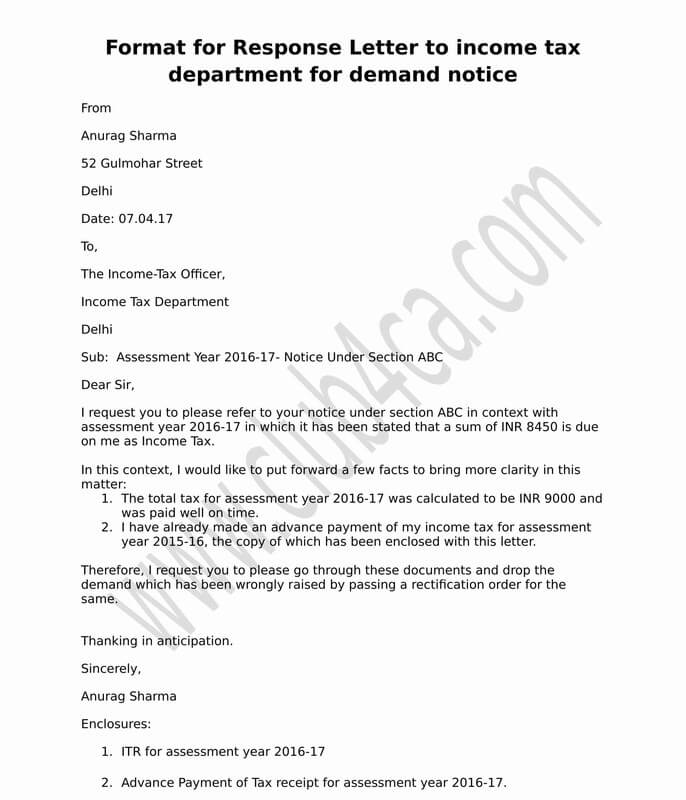

What is response to notice of non- filing of ITR. The income tax department may issue a notice under Section 271F for non-filing of IT Return. Response can be either you have filed.

However it is important to file an income tax return regardless if the income doesnt surpass the taxable limit.

What Is A Cp05 Letter From The Irs And What Should I Do

Preparing Tax Returns For Inmates The Cpa Journal

Non Filling Of Income Tax Return Cib 321 Income Tax Notification

How To Reply Notice For Non Filing Of Income Tax Return

Irs Letter 1615 Mail Overdue Tax Returns H R Block

How To Respond To Non Filing Of Income Tax Return Notice

Now Get More Time To Reply To An Income Tax Notice

What Is Irs Form Cp 575 And What To Expect Gusto

Letter Format To Income Tax Department For Demand Notice

Gstr 3a Notice For Not Filing Gst Return Indiafilings

Income Tax Notice 10 Reasons Why You May Get A Notice From The Income Tax Department

Gstr 3a Notice For Not Filing Gst Return Indiafilings

Have You Received Non Filing Notice From Income Tax Department Here Is What It Means And What You Should Do G P K Tax Consultants

We Definitely Didn T All Forget To Pay Our Dc Taxes Those Years Popville

How To Reply Your Income Tax Notice Issued By Income Tax Dept Youtube

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

3 Ways To Write A Letter To The Irs Wikihow

Irs Letter 2566 Proposed Individual Tax Assessment H R Block